The Ultimate Guide To Check Cash Payday Loans

Wiki Article

4 Simple Techniques For Payday Loans Online

Table of Contents10 Simple Techniques For Fast Payday LoansThe Only Guide to Payday Direct LoansPayday Check Loans - An Overview3 Simple Techniques For Payday Direct Loans

A $15 fee per $100 borrowed is relatively typical. A $15 fee on a $100 loan may not appear like much. On a two-week financing, that works out to an annual portion price (APR) of virtually 400%. Cash advance are among the most expensive sources of non-mortgage consumer debt.

17% as of February 2022. For a 24-month personal lending, the typical APR was 9. 41%, according to the Federal Reserve. Pro Suggestion Cash advance are prohibited or severely restricted in 18 states and also the District of Columbia, according to The Bench Charitable Trust Funds. Other states have differing degrees of safeguards.

That indicates Amy requires ahead up with $300 quickly. She goes to a shop payday loan provider and also uses for a $300 lending this month while she figures out exactly how to resolve her month-to-month shortfall. To obtain $300, Amy needs to pay a $45 money charge. That doesn't seem like a lot.

5 Easy Facts About Check Cash Payday Loans Described

That suggests Amy is paying an APR of virtually 400%. When the loan comes due, Amy doesn't have $345. The money she obtained went toward her higher lease and daycare expenses. So she pays a $45 charge to surrender the loan. She currently has actually invested $390 on her $300 finance - https://www.twitch.tv/ch3ckc4shlns/about.Several financial organizations will likewise charge you a charge. However at the extremely least, you can quit the loan provider from taking cash you require for fundamentals, like lease or food. Note that when you apply for on-line cash advance loans, it's often difficult to tell if you're using with a real lender or a lead generator that sends your information to lending institutions.

Some states need lending institutions to supply debtors a layaway plan without charging extra costs. In other states, lenders have to enable battling debtors to enter a repayment plan, however they're allowed to add additional costs. No matter your state's regulation, it frequents a lending institution's interest to deal with you.

Another alternative is to tell the lending institution you're so overwhelmed by costs that you're considering insolvency. Numerous lending institutions are willing to jeopardize in this situation since they recognize it's likely they would not obtain anything in bankruptcy court.

Check Cash Payday Loans for Beginners

Also though cash advance lending institutions call this charge a charge, it has a 391% APR (Yearly Percentage Rate) on a two-week financing. When the loan provider makes the financing he should tell you in writing exactly how a lot he is charging for the financing and also the APR or interest rate on the finance.It is illegal for them to give you more than that. If you obtain $550 you will certainly owe the loan provider $632. 50. have a peek at this site You can just have one payday advance loan each time. That finance has to be paid completely prior to you can takeout one more. When the loan provider makes the financing he will certainly need to put your information into a data base utilized only by other payday lending institutions as well as the state firm that monitors them. Direct Payday Loans.

If you still owe on a payday advance loan as well as most likely to another lending institution, that loan provider will certainly check the information base as well as by regulation have to reject you the funding. As soon as you repay your payday advance loan, you can obtain a new one the next business day. After you get seven payday advance loans in a row, you will certainly need to wait 2 days prior to you can takeout a new lending.

They can't also tell you that you can be detained or placed in prison. If your check does not clear, then your financial institution will certainly charge you for "jumping" a check, and the lending institution can bring you to Civil Court to collect the cash you owe. Obviously, if a cash advance loan provider transfers the check, it could trigger various other checks you have written to jump.

The Payday Direct Loans Ideas

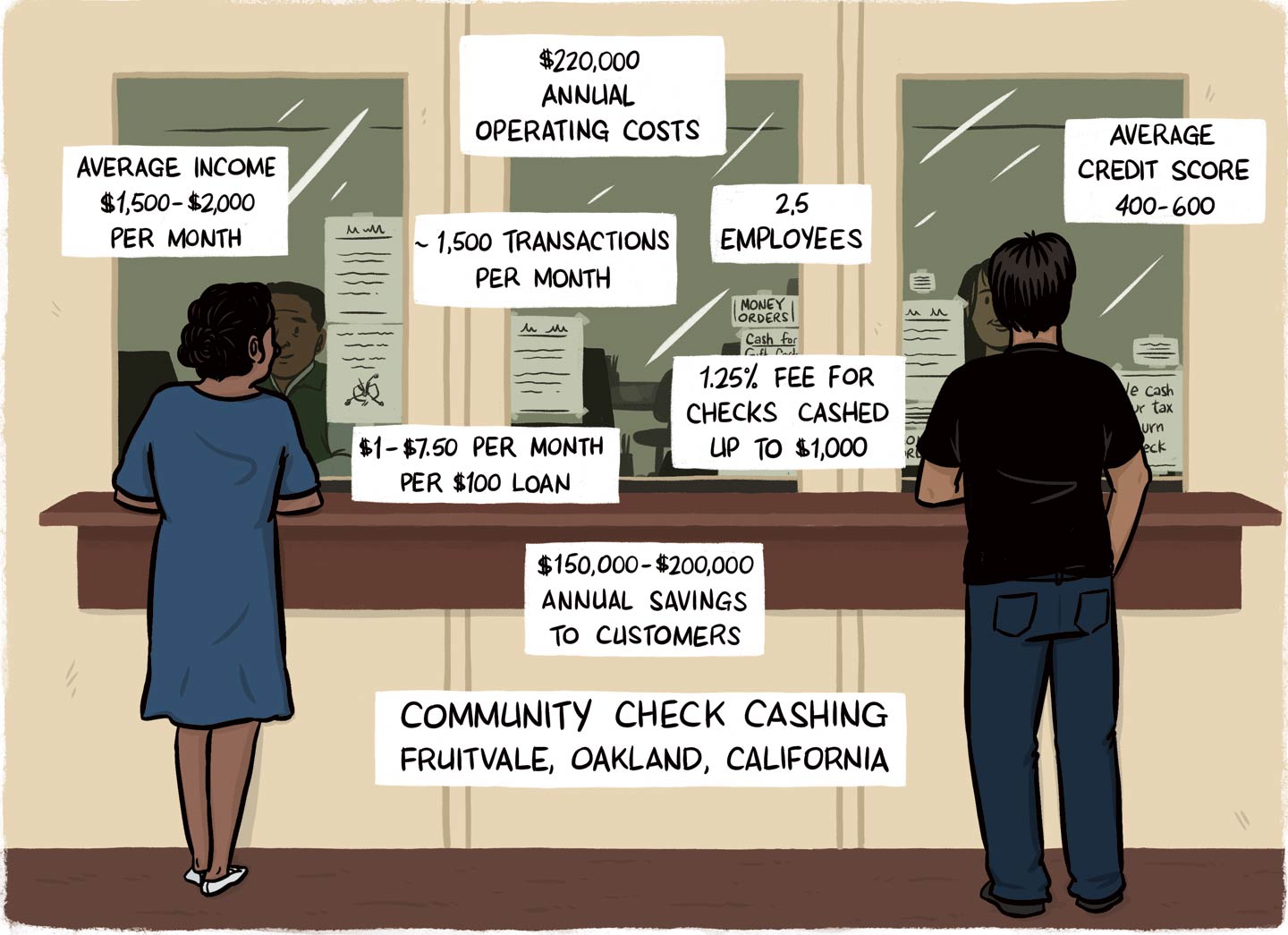

They may additionally approve your energy costs payments without charging a fee. With normal checkcashing, the business does not "hold" the check before cashing it, however pays it right away for a cost.

If you want to cash a preprinted paycheck or government check for $150 or less, then they can bill you $3. 00, and if the check is for even more than $150, after that they'll bill you 2% of its worth.

Report this wiki page